Revolutionising P2P Lending Experience with Blockchain

Speculative Trading

Market volatility leads to marginal returns for investors, making traditional speculative investments unreliable.

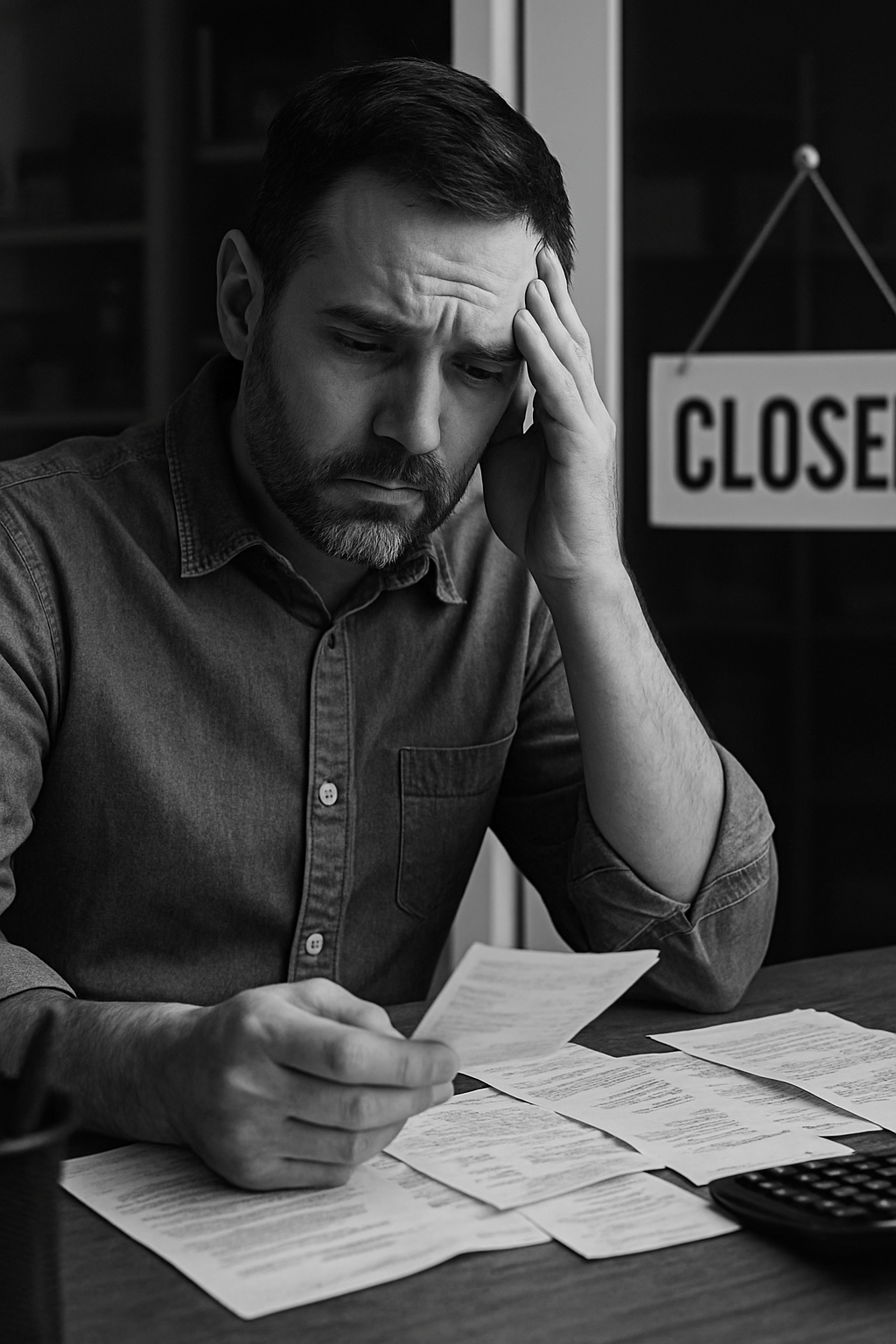

SME Lending needs a New Approach

No Sustainable Output

A major concern in the industry is the prevalence of "rug pull" projects and token dumping, resulting in financial instability.

Low SME Financing

SMEs in the Asia-Pacific region remain a key economic driver but lack sufficient financing options to grow.

Accessing Liquidity

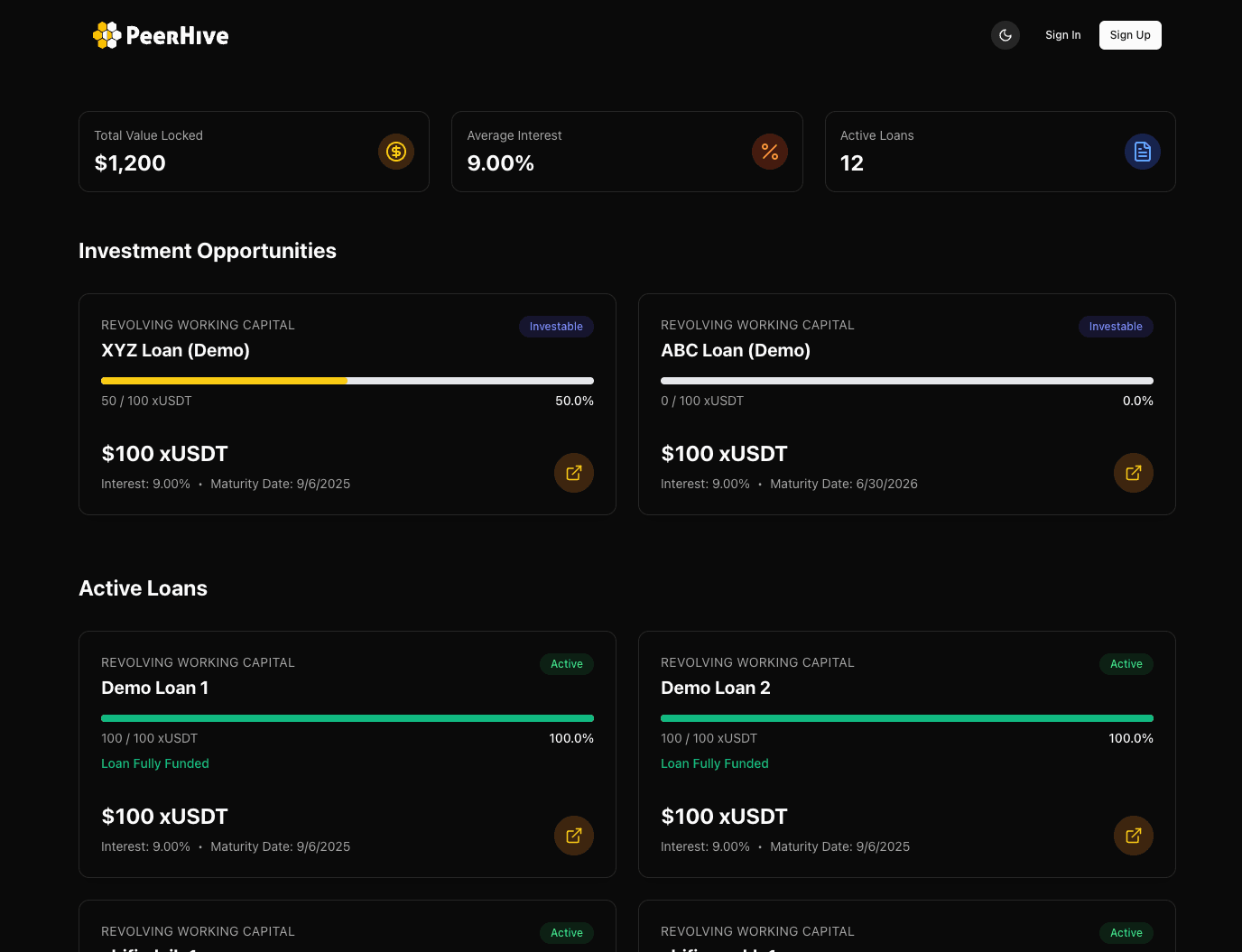

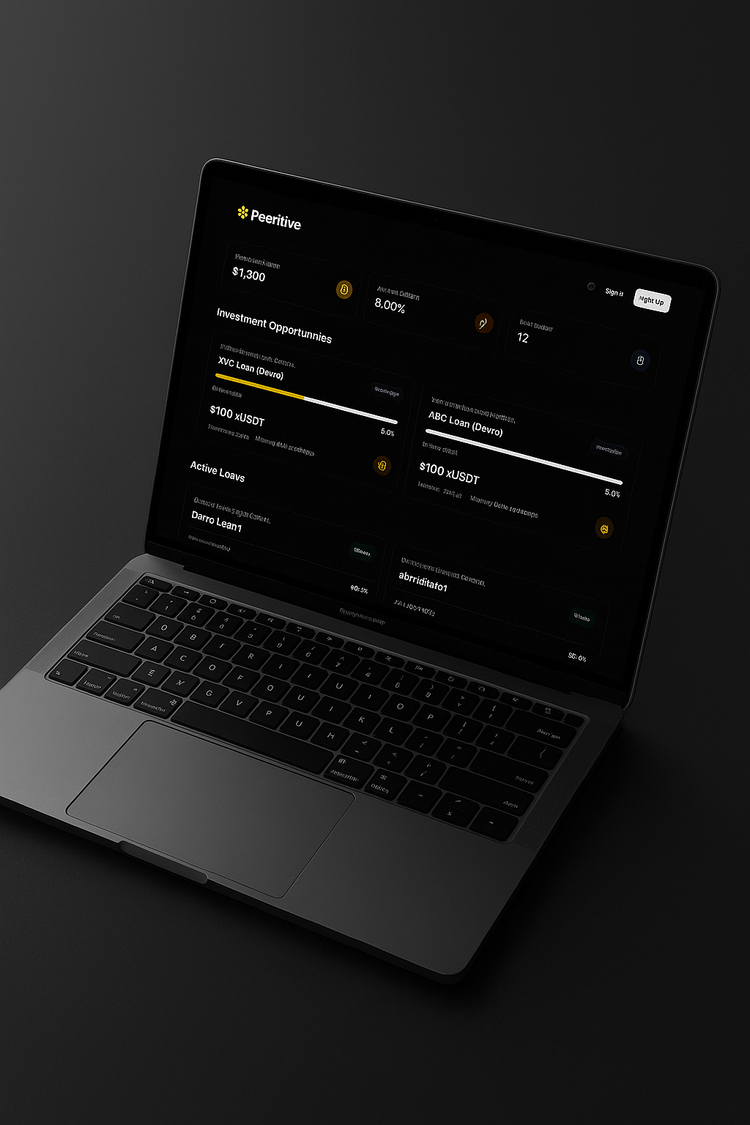

Lenders now have access to high-quality investment that is not speculative in nature.

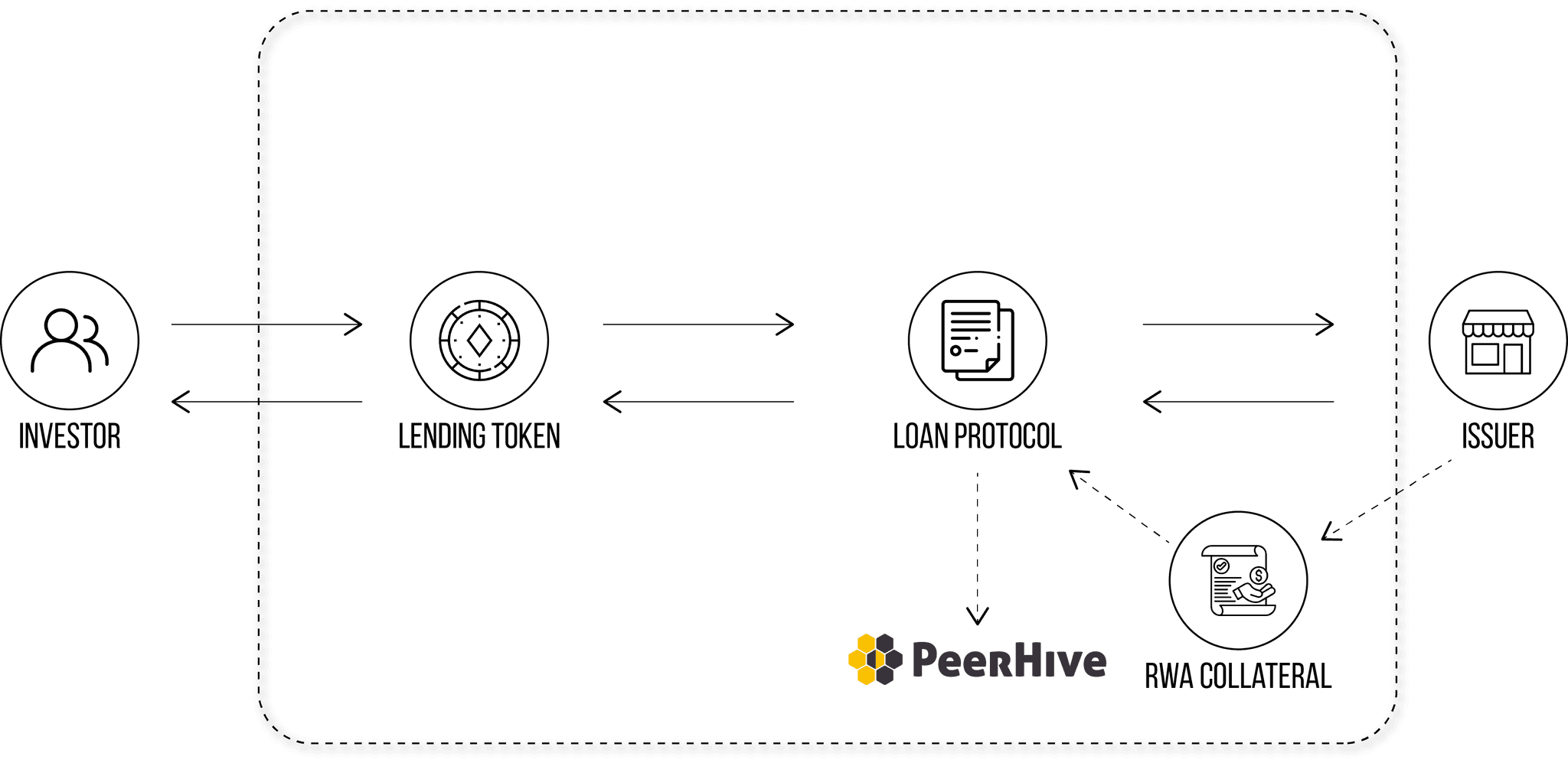

Bridging Real World

By addressing the needs of SME financing with the help of Real-World Asset (RWA).

Increasing Opportunity

Leverage on the power of blockchain to enable cross-border lending to be efficient and cost-effective.

Direct liquidity, asset-backed funding, and blockchain lending for SMEs.

A USD 2.4 TRILLION MARKET

DEMANDING FOR MORE FINANCING

ASIAPAC UNMET

FINANCING NEEDS

TOTAL AVAILABLE MARKET

10% OF TOP 3 STABLECOIN

MARKET CAP

SERVICEABLE AVAILABLE MARKET

TOTAL REVENUE

OPPORTUNITY

SERVICEABLE OBTAINABLE MARKET

INVOICE FINANCING

TO 2% INTEREST CHARGE

WORKING CAPITAL

TO 2% INTEREST CHARGE

Waitlist sign ups

We have built PeerHive in public on and amassed nearly 200+ signups are ready to start using PeerHive.

Potential Clients

Businesses that have expressed interest in our P2P lending platform and are ready to explore partnership opportunities with PeerHive.

Telegram Community

Active members in our Telegram community discussing blockchain-based P2P lending solutions and contributing to PeerHive's development.

PeerHive Enters SC Malaysia

Regulatory Sandbox

* PeerHive is participating in the SC Malaysia Regulatory Sandbox in a controlled environment for testing purposes only. This does not imply endorsement or market approval.

Read the Press Release →